Why You Need to Enable MORE Notifications

We receive far too many notifications from services that don't matter and far too few notifications from services that do (specifically services that deal with your money).

Your email and phone are already inundated with chatter from all types of companies trying to get you to spend money. grouponlivingsocialscoutmobthrillist send daily emails because apparently we all like to buy items on the daily. Instagram, Facebook, LinkedIn, and the rest of the social motley crew have severe self-confidence issues and, on default settings, will desperately notify you on the regular if they even sense you are not using their product frequently.

So why the (misleading) post title? Because we actually have an issue of notification misconfiguration. The above notifications are distractions to your focus and should be turned off, yet few of us do. On the flip side, how many of us have signed up to get notifications when:

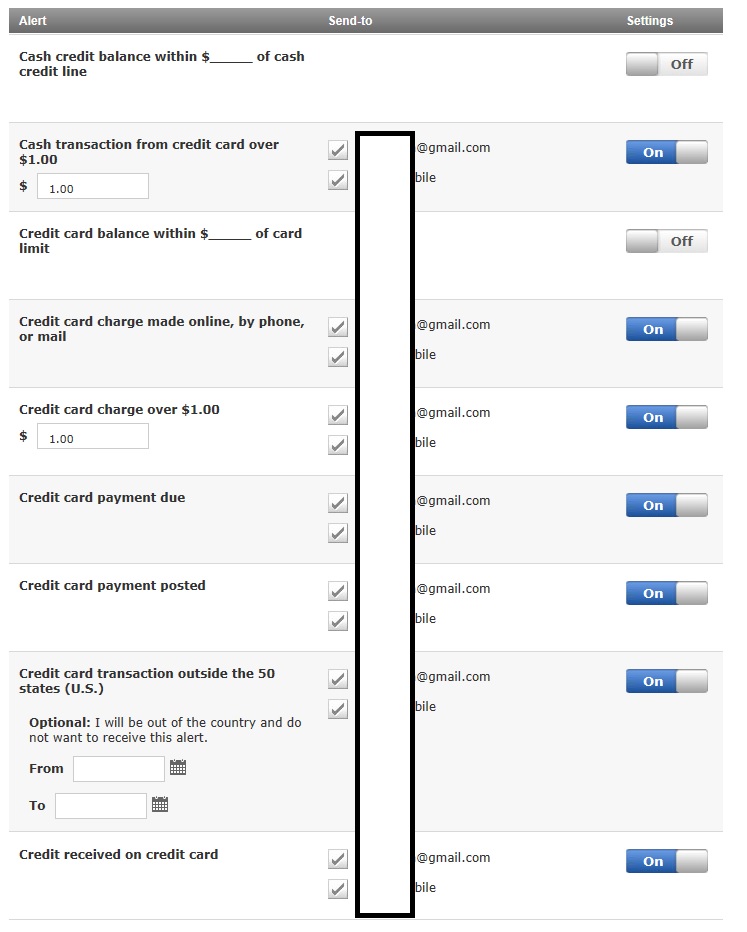

- our credit card is used overseas?

- a direct deposit or draft occurs on our bank account?

- that debit card you never use has a new $100 charge?

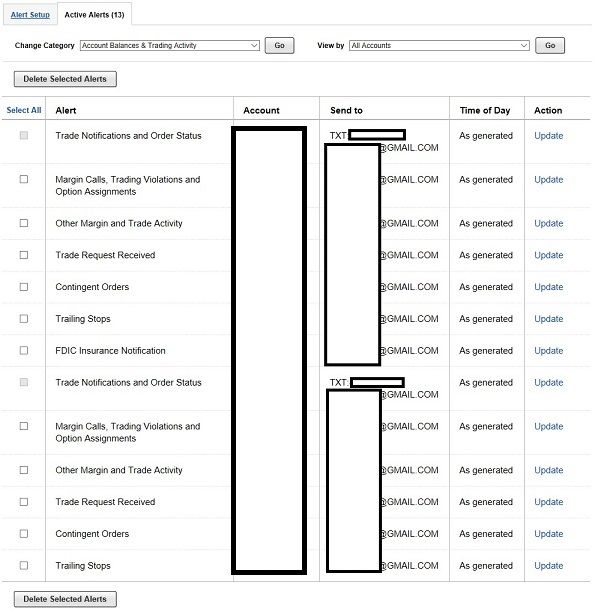

- your 401k has a trade confirmation?

- your mobile phone provider changes the email associated with your account?

We receive far too many notifications from services that don't matter and far too few notifications from services that do (specifically services that deal with your money). I suggest visiting your accounts for banking, retirement, social payments (venmo, etc), utilities, internet/mobile services, and any account that touches your money to enable as many notifications as possible - you can always remove them later.

Some tips:

- For certain accounts/cards, you may want any action involving money (even the minimum $1 amount transaction) to deliver a notification so you can keep up to date on all your personal purchases. For business oriented cards you might change the threshold to a higher amount if the card is used several times a day.

- Sometimes you might have a discrepancy while checking out at the supermarket (did the first canceled transaction actually go through?) or the restaurant (did the host actually charge you more than the bill indicated?). Enabling per transaction alerts will give you instant feedback and peace of mind by showing you the exact pending charge actually sent to your card.

- It can be advantageous to setup alerts on email, sms, and even your google voice number, especially for international travel. Often times we may have spotty cell service, have a phone stolen and only have a laptop, or only have a data plan/wifi available. I've instantly been notified of suspect transactions while traveling internationally without cell service via google voice 'SMS' (actually delivered over wifi).

- Purchase notifications delivered to your phone can leak information about your purchases and activity (a lockscreen notification like "A charge of $28.20 at 1-800-FLOWERS on 02/14/2015 is greater than your $0.00 limit in your Alerts settings." could tip off your significant other on a present). You may want to enable enhanced privacy settings for lockscreen notifications if this is a concern.